cryptocurrency tax calculator australia

How to calculate your crypto tax in Canada. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes.

Koinly Crypto Tax Calculator For Australia Nz

At Etax we want to help you understand how cryptocurrency investments are taxed so we put together this simple guide to cryptocurrency and tax in Australia.

. The Australian Tax Office ATO is gearing up to send out close to 350000 notices to cryptocurrency investors in effort to remind them of their tax obligations. Assessable income is calculated by. For it brilliant data analyzing ability it won the Product Hunt Global Hackathon in 2017.

In order to use the cryptocurrency tax calculator effectively youll need to provide a number of specific details about the cryptocurrency asset you have. The Australian Crypto Tax Guide. For cryptocurrency traders the formula differs a bit.

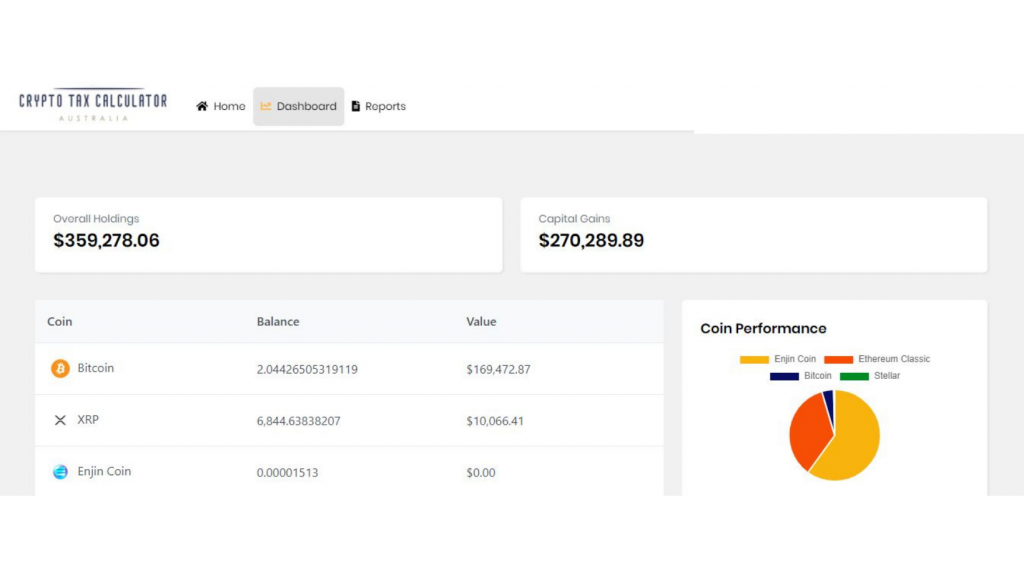

This platform directly imports data from crypto wallet merchants. Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

This allows us to calculate the tax rate that will be applied to your cryptocurrency capital gains. Income - Tradings GainsLosses Deductions. Swyftxs cryptocurrency tax calculator Australia gives you an estimate of what tax youll pay on profit made from a crypto sale.

Cryptocurrency is classed as an asset in Australia and is taxed under capital gains tax rules with gains or losses denominated in Australian dollar amounts upon disposal of cryptocurrency. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800. After importing your trades CoinTracking calculates the gainslosses for every trade according to the accounting method used in Australia.

However its best to speak to a tax accountant who specialises in cryptocurrency for further advice. CoinTracking is the best crypto tax software for Australian traders making it easy to import all your trades from 110 exchangeswallets including DeFi and NFTs. Sally buys 2 BTC on Monday for 5000 each.

As Tim Brunette co-founder of Crypto Tax Calculator an Australian startup that has leapt up in the crypto-adjacent space. We cover how to calculate your taxes how to minimize your capital gains and what is required to be reported by the Australian Tax Office. This guide breaks down the implications of cryptocurrency transactions from a tax perspective to put you in a better.

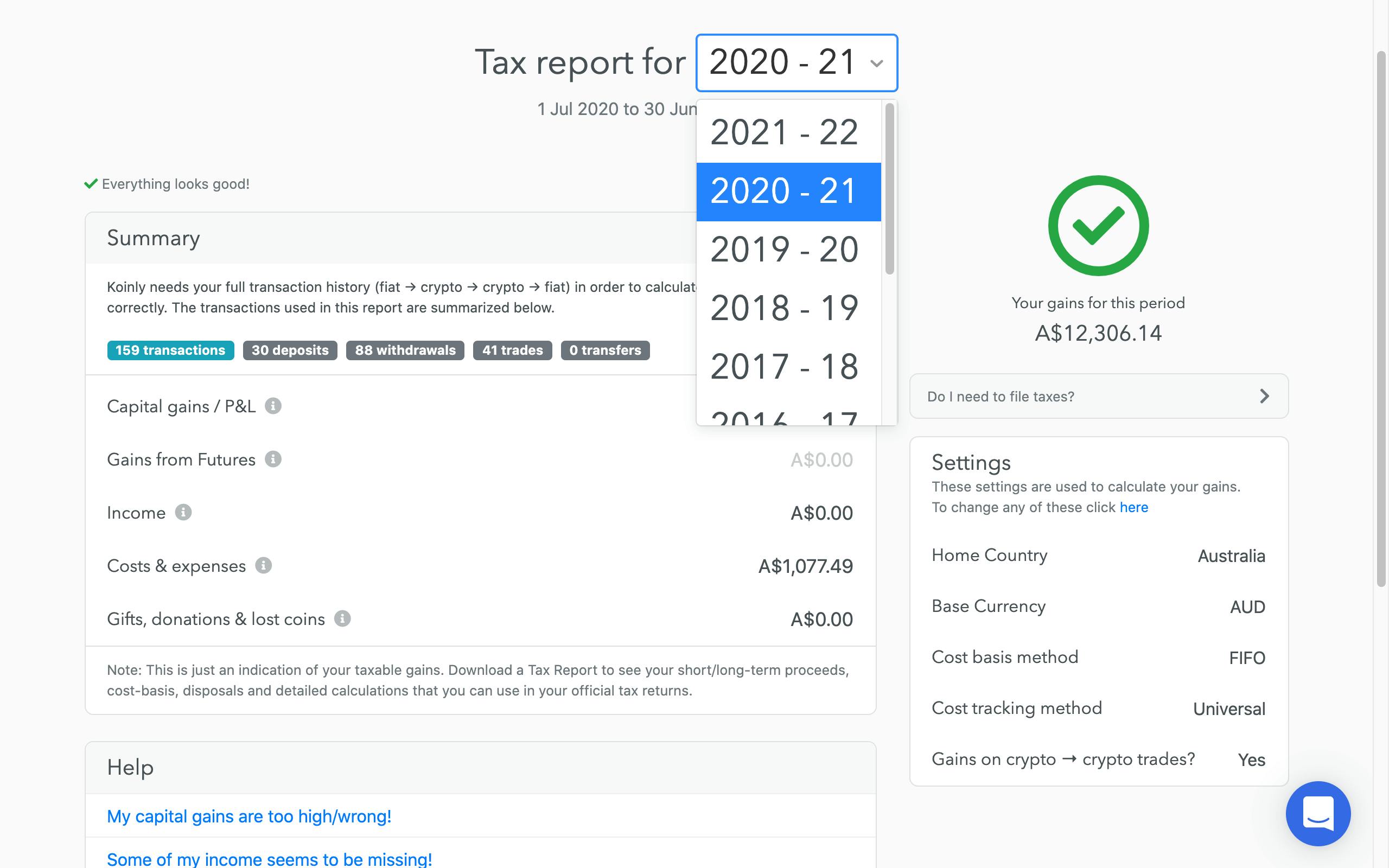

Koinly was built to solve this very problem - by integrating with all major blockchains and exchanges such as Coinbase Binance Kraken etc Koinly reduces crypto tax reporting to a few. The formula for calculating accessible income is Income Capital Gains Deductions. It should get you up to speed with how to prepare and help you avoid possible ATO troubles in the future.

Koinly is a cryptocurrency tax software for hobbyists investors and accountants. You will need to pay tax if you buy cryptocurrency and later sell or exchange it at a higher price. You will also learn how to generate and file your crypto tax.

To calculate your capital gains you can take the cost of the Bitcoin in AUD at time of purchase and subtract that from the proceeds you made at the time of sale in order to calculate your profit or loss. Cryptocurrencies may not exist physically beyond their blockchains and crypto wallets but they are treated as taxable goods by government agencies paid in fiat currencyYou should take into account several factors and tax rules when deciding on how to pay your taxes since it is a complex process. The cryptocurrency tax calculator provides users with an estimate of the capital gains tax incurred when a cryptocurrency asset is sold traded or otherwise disposed of.

Crypto Tax Calculator for Australia. If you are an Aussie who has been trading cryptocurrencies over the past years there is a. For example if you paid 5000 for Bitcoin or swapped 5000 worth of ETH for Bitcoin your cost basis is 5000.

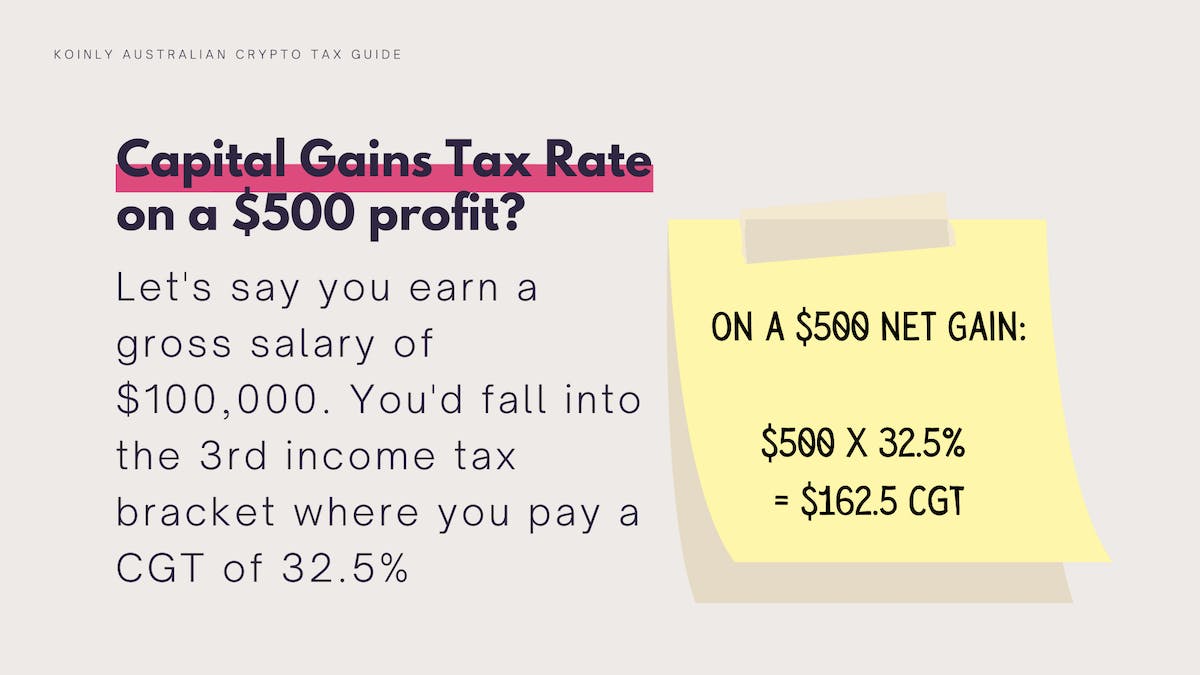

If you are a cryptocurrency investor your tax rate will be determined by your overall assessable income based on Australias sliding scale of individual tax rates. Cryptocurrency generally operates independently of a central bank central authority or government. TokenTax is a crypto tax management company that was founded by Alex Miles back in 2017.

As a cryptocurrency investor the amount of tax you pay is based on your overall assessable income. ATO How to minimize cryptocurrency taxes. Cryptocurrency tax rate.

TokenTax works as a cryptocurrency tax calculator that connects to every crypto exchange. Australian taxpayers get a little breathing space with a number of tax-free thresholds and allowances that happily apply to cryptocurrency tax too. In this guide you will learn everything you need to know about bitcoin and cryptocurrency taxation in Australia.

If you are an individual and dispose of cryptocurrency this is usually considered a tax event. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. ATO Tax Reports in Under 10 mins.

Tax treatment of cryptocurrencies. In this guide we look at the basics of cryptocurrency tax in Australia to help you learn what you need to do to keep the taxman happy. Using The Australian Cryptocurrency Tax Calculator.

Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly. This is why cryptocurrency tax Shane explains is kind of a. This is your total taxable income for the year you sold the crypto asset including your wage and other sources of income.

However its best to speak to a tax accountant who specialises in cryptocurrency for further advice. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. This is by far the largest crypto compliance effort conducted by a government to date.

You will only start to pay Income Tax when your hit 18200 in total income per year. Cryptocurrency tax is a new and emerging space in Canada with much speculation about different crypto scenarios and how they are taxed. Updated on December 28 2020.

Assessable Income Income Capital Gains Deductions. Swyftxs cryptocurrency tax calculator Australia gives you an estimate of what tax youll pay on profit made from a crypto sale. Calculate crypto tax in 20 juristictions.

ATO has a sliding scale of individual tax rates that you can use to determine the tax owed.

![]()

Cointracking Crypto Tax Calculator

![]()

Cointracking Crypto Tax Calculator

Top 10 Crypto Tax Return Software For Australia Crypto News Au

Cryptocurrency Tax Software Crpytotrader Tax Now Available In Australia Bitcoin Com Au

Crypto Tax In Australia The Definitive 2021 2022 Guide

![]()

What Is My Tax Rate For My Crypto Gains Cointracker

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Tax Australia Cryptocurrency Tax 2021 Guide Fullstack

Next Steps Australia Crypto Tax Report Cryptotrader Tax

Top 10 Crypto Tax Return Software For Australia Crypto News Au

Crypto Tax Calculator Australia Calculate Your Crypto Tax

Crypto Tax Calculator Australia Calculate Your Crypto Tax

Cryptocurrency Tax Software Crpytotrader Tax Now Available In Australia Bitcoin Com Au

The Ultimate Australia Crypto Tax Guide 2022 Koinly

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Australia Tax Rates For Crypto Bitcoin 2022 Koinly

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda